Part V Perfecting an Article 9 Security Interest

Chapter 23 Continuing Perfection -- The Need To Reperfect (Or Refile)

A. Generally

1. An Overview

This chapter and the next deal with the important reality that perfection generally does not continue indefinitely. Often it will be necessary to take action to continue perfection. Knowing when action is necessary and what action to take and when to take it requires a command of the rules governing perfection in the first instance and also an understanding of the rules governing the duration of perfection.

Perfection achieved by properly filing a financing statement can end if the financing statement lapses or is terminated. Moreover, when there is a change in the circumstances under which the particular action taken was effective to perfect, such as a change in the debtor's name or location, third parties may be mislead and reperfection or refiling may be required. Perfection also may cease because it was conferred only for a limited period. This happens where temporary perfection is given for a specific limited purpose. See new sections 9-312(f), (g) and (h).

More importantly, as seen in Chapter 16 (Perfecting Security Interests in Proceeds and Other Later Acquired Property), perfection as to certain types of proceeds does not continue beyond the twenty-day period of perfection automatically conferred by new sections 9-315(c) and 9-315(e) unless the secured party acts to timely reperfect.

Ideally, when a creditor acts to reperfect the result will be continuous perfection in the sense that the filing or perfection dates from the time of the original filing or other action to perfect was taken. Former Article 9 employed the concept of continuous perfection without defining it. New section 9-308(c) explicitly provides that a security interest (or agricultural lien) is perfected continuously if it is originally perfected in one manner under this article and it is later perfected in another manner under this article without an intervening period when it was unperfected.

2. The New Article 9 Transition Rules

For a period of time after the effective date of new Article 9, July 1, 2001, there was an important question of what would happen to a security interest created and perfected under former Article 9. The transition rules of Part 7 of new Article 9 were included to deal with this question. These rules are complicated and sometimes difficult to understand. It will be a rare case today that a transition issue arises, but it is useful to be aware of the Part 7 rules, not only to deal with such a rare case but also because many of the reported decisions applying new Article 9 were entered during the transition period and the rules were referred to by the courts.

B. The Life of a Financing Statement

1. Lapse of a Financing Statement

As was true under former Article 9, section 9-403(2), a filing may lapse under new Article 9 unless it is timely continued. Under new section 9-515(a), a regular initial financing statement is effective for five years after the date of filing. Some states, including Arizona, modified former Article 9 to extend the period to six years, but Arizona has gone with the five-year period in connection with its adoption of new Article 9.

Where the debtor is a transmitting utility if the financing statement so indicates a filing is good until terminated and a mortgage serving as a fixture filing is effective until the mortgage is released or satisfied of record. New 9-515(f) and (g). Under new Article 9, as to public finance transactions or manufactured-home transactions, if the financing statement so indicates a filing is good for a period of thirty years. New 9-515(b). However, as to most filings, the five-year period governs and as was true under former Article 9 action is needed to continue the effectiveness of the filing beyond that period.

As also was the case under former Article 9, to continue the effectiveness of a financing statement beyond the five-year period applicable to the vast majority of filings a secured party must timely file a continuation statement, as provided for in new section 9-515(d).

To be effective as a continuation statement a filing must indicate that it is a continuation statement and identify the filing it is intended to continue. New Article 9 so provides by defining a continuation statement in new section 9-102(a)(27) as an amendment of a financing statement that identifies the initial financing statement to which the continuation statement relates and indicates that it is a continuation statement. There is a "safe harbor " form in new section 9-521(b) to assist secured parties to file the appropriate record.

Under new section 9-515(d) a continuation statement may be filed only within six months before the expiration of the five-year period specified in section 9-515(a). A continuation statement that is not filed during the window of time provided in new section 9-515(d) must be rejected by a filing officer, see 9-516(b)(7), but even if the statement is accepted for filing it is not effective to continue the original filing. See new 9-510(c).

Under new section 9-515(e), a timely filed continuation statement continues the effectiveness of the original filing (or an earlier continuation statement) for five years beyond the time the original financing statement or continuation period would have lapsed.

As explained in Chapters 13 (Overview of Perfection by Filing) and 14 (The Nitty Gritty of Filing), under new Article 9 the controlling question as to any filing is whether the filing has been properly authorized. New section 9-509(b) provides that a debtor authorizes a secured party to file an initial financing statement “and an amendment” when the debtor authenticates the security agreement. The authorization to file a continuation statement is limited to an amendment that does not change the information in and rather simply continues the effectiveness of the original financing statement. Amendments that make substantive changes to a financing statement, for example, adding collateral, require separate authorization. See new New 9-512.

As noted above, if a continuation statement is not timely filed the financing statement "lapses." Under new section 9-515(c), when a filing lapses a security interest becomes unperfected and is deemed never to have been perfected as against a purchaser (which includes a secured party) of the collateral for value. Former Article 9 also contained such a "retroactive" non-perfection scheme but a secured party was at risk as to lien creditors as well as purchasers. Under new section 9-515(c), there is retroactive non-perfection only as to a purchaser and not a lien creditor (including a trustee in bankruptcy).

To illustrate new section 9-515(c), if a security interest that is perfected by filing has priority over another security interest according to the usual filing rules, see Part VI, but the filing as to the first security interest is not timely continued then the later security interest may have priority. For example, if the later secured party acquired its interest and perfected in the five-year period during which the first filing was effective but the first filing was allowed to lapse then the secured party who filed first cannot rely on the lapsed filing to establish priority.

A careful reading of new section 9-515(c) reveals that if a party is not relying on the lapsed filing for perfection and priority, but is "otherwise perfected" so as to give that party priority (for example, by having filed another financing statement that is first in time), the retroactive non-perfection rule of new section 9-515(c) does not operate to subordinate the party whose filing has lapsed.

Under former Article 9 a new financing statement could not serve the purpose of a continuation statement -- even if the financing statement was filed in the six-month period preceding the lapse of the original filing -- because it did not properly identify the initial financing statement (or earlier continuation statement). See, e.g., In re Halyard Drilling Co., 840 F.2d 596 (8th Cir. 1985); In re Hays, 47 B.R. 546 (Bkcy N.D. Ohio 1985). New section 9-515(c) and the definition of a continuation statement in new section 9-102(a)(27) codify these decisions.

Thus, under new Article 9, a new financing statement will not operate as a continuation statement. However, a new financing statement could "otherwise perfect" within the meaning of new section 9-515(c) and that filing could give a party priority despite the fact that the lapse of its initial filing results in retroactive non-perfection based on the lapsed filing.

Decisions under former Article 9 further made clear that a continuation statement filed before the beginning of the six-month period for filing a continuation statement or after the end of that period was not effective as a continuation statement. New section 9-510(c) is to the same effect. Under former section 9-403(2), if a debtor filed bankruptcy the period for filing a continuation statement was "tolled." That protection has been dropped from new Article 9. It is now incumbent on a secured party to properly continue the effectiveness of a filing during bankruptcy. The BRA was amended in 1994 to make clear that filing a continuation statement during bankruptcy does not violate the automatic stay.

Given the critical importance of the timely filing of a continuation statement and the dire consequences of a failure to do so, including retroactive non-perfection of a security interest against a purchaser under new section 9-515(c), there arises the question of who as between the client and the client’s attorney is obligated to make sure that a continuation statement is timely filed.

This question is the subject of Barnes v. Turner, 606 S.E. 2d 849 (Ga. 2004). To examine the decision click on the case name. Oversimplifying somewhat, the majority in Barnes concluded that where continued financing is reasonably contemplated an attorney has a duty either to file a continuation statement or to advise the client that such a statement must be timely filed and an attorney who fails to do either may be liable for malpractice.

Although not at issue in Barnes, the court's reasoning could apply as well to a situation where an attorney fails to advise a client that a termination statement should be filed to avoid subordination of the client's security interest to a creditor who could have priority under the first-to-file priority rule in new section 9-322(a)(1). Termination statements are discussed in the next subsection. The first-to-file rule is considered in Chapter 28 (Secured Party Versus Secured Party).

2. Termination of a Financing Statement

Under new section 9-513(d), an otherwise effective financing statement ceases to be effective when a “termination statement” is filed. As defined in new section 9-102(a)(79) a termination statement is an amendment to a financing statement that identifies the financing statement and indicates that the amendment is a termination statement or that the identified financing statement is no longer effective. The rules governing when and how termination statements must be filed are somewhat complicated.

Under former section 9-404(1), in consumer goods cases a secured party was required to file a termination statement within a month (or within ten days after a debtor made a written demand) after the debt had been paid (assuming there was no commitment to make further advances). In other cases a secured party was only obliged to provide the debtor with a termination statement and had to do so only on written demand by the debtor after no debt or commitment to make a future advance was outstanding and there was no time within which a secured party had to act in other than consumer goods cases. If a secured party failed to file or provide a termination statement as required by former section 9-404(1), the financing statement continued to be effective but the secured party was liable to the debtor for $100 and actual damages.

New section 9-513, in more elaborate and structured terms, tracks former section 9-404(1). Thus, under new sections 9-513(a) and (b), in consumer goods cases, a secured party is required to file a termination statement within a month (or within twenty days after receiving an authenticated demand from the debtor) after the debt has been satisfied and there is no commitment to make a future advance.

Under new section 9-513(c), in other than consumer goods cases, if the debt has been satisfied and there is no commitment to make a future advance, a secured party must send the debtor a termination statement within twenty days after receiving an authenticated demand from the debtor. Further under new section 9-513(c), where the financing statement covers accounts or chattel paper that has been sold a secured party is required to provide a termination statement only where the account debtor or other obligated person has discharged its obligation and in consignment cases only where the consigned goods are no longer in the debtor's possession.

New sections 9-513(a)(2) and (c)(4) add to the other situations in which a secured party is required to file a termination statement the case where the debtor did not authorize the filing of a financing statement. As to "bogus filings," see Official Comment 3 to 9-513 and Chapter 14 (The Nitty Gritty of Filing).

Under new section 9-513, as was true under former section 9-404(1), if a secured party fails to file a termination statement as required by new Article 9 the financing statement continues to be effective. A party who is aggrieved by the failure (which may include persons other than the debtor) is left to the remedies provided for in new section 9-625, including actual damages and statutory damages. See Chapter 38 (Remedies for a Secured Party's Failure to Comply with Article 9).

You may explore the basics of the lapse and continuation statement and termination statement scheme of new Article 9 in the next two problems.

Problem 23.1 (interactive)

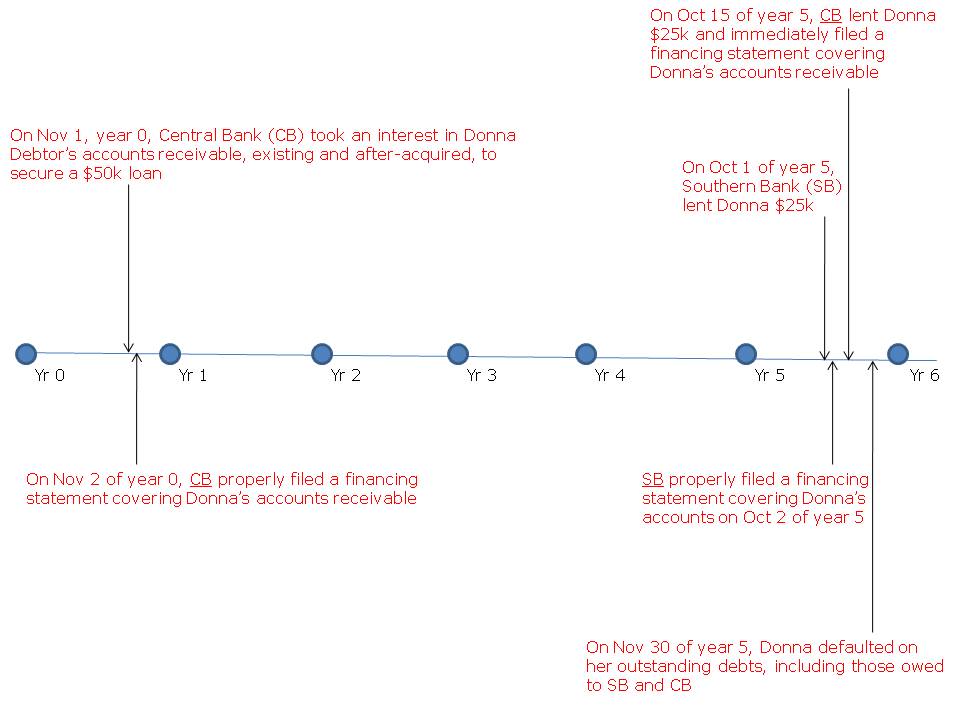

On November 1, Year 0, Central Bank (CB) took an interest in Donna Debtor's accounts receivable, existing and after-acquired, to secure a $50,000 loan to Debtor. The agreement signed by Donna provided that her accounts would secure any future advances that CB should choose to make to Donna. On November 2, Year 0, CB properly filed a financing statement covering Donna's accounts receivable. On October 1, Year 5, Southern Bank (SB) lent Donna $25,000. To secure the loan SB took an interest in Donna's existing and later-acquired accounts. SB properly filed a financing statement covering Donna's accounts on October 2, Year 5. As of the date of the SB loan, Donna had paid off the entire balance owing on the debt to CB. On October 15, Year 5, CB lent Donna $25,000. CB immediately filed a financing statement covering Donna's accounts receivable. On November 30, Year 5, Donna defaulted on its outstanding debts, including those owed to CB and SB. On that date Donna's accounts were worth $25,000.

SB gets the $25,000 under new Article 9, right? Explain why. (Your analysis will be aided by drawing a time line that captures the situation chronologically. An example of such a timeline is set forth below after the questions.)

What should CB have done to avoid being subordinated?

Why did CB’s filing on October 15, Year 5 not continue the effectiveness of CB’s initial filing on November 2, Year 0?

If CB had filed a continuation statement on May 15, Year 5, would its filing on November 2, Year 0 have continued to be effective (not have lapsed)? If CB had filed a continuation statement on October 15, Year 5, when would its November 2, Year 0 filing have lapsed?

What could (should) SB have done to avoid any risk of being subordinated to CB's interest?

Would Donna be entitled to request and receive a termination statement on the stated facts of Problem 23.1?

If instead of lending the $25,000 on October 15, Year 5 and filing a financing statement on October 15, Year 5, CB had lent the $25,000 and filed on September 15, Year 5, would SB get the $25,000? Assume again that CB failed to timely file a continuation statement.

Assume further that instead of SB making a loan on October 1, Year 5 that Donna suffered a levy on that date. Would CB be deemed to be unperfected against the lien creditor?

Suppose that CB filed a malpractice action against its attorney based on the fact that no continuation statement was filed. What issues are raised by such an action and how are they likely to be resolved?

If CB had timely filed a continuation statement, could SB successfully sue its attorney for malpractice? Explain your answer.

Problem 23.2 (interactive)

Assume the facts of Problem 23.1. Assume further that on the date that Donna Debtor paid the debt owed to CB, Donna sent CB an authenticated demand that CB send her a termination statement.

Would CB be required to send a termination statement to Donna?

If so, how long would CB have to provide the termination statement?

Suppose CB failed to comply with Donna's demand. Would the financing statement continue to be effective? What recourse, if any, would Donna have against CB?

C. The Effect of Name Changes, Transfers that Result in Name Changes and New Debtor Situations

In the remainder of this chapter and Chapter 24 (Continuing Perfection -- Changes as to the Use of the Collateral or in the Location of the Collateral or the Debtor; Security Interests in Proceeds), we look at specific changes that may (or may not) require action essentially because a change may somehow be misleading to potential creditors (searchers). You will discover that the code drafters have sought to strike a balance (not necessarily always a good balance or an obviously reasonable one) between imposing additional burdens on filers or on searchers. We start with name changes, transfers of collateral that result in name changes, and new debtor situations.

1. Changes to the Debtor’s Name

It should be clear why name changes may require refiling. If it is not, you should review carefully the materials dealing with the operation of the filing system in Chapter 14 (The Nitty Gritty of Filing). Name changes sometimes are "simple," meaning that the debtor continues as the debtor but the debtor's name changes. At other times not only is there a name change but a debtor other than the original debtor becomes involved, thereby presenting the ''dual" and "new" debtor cases dealt with in subpart B below.

a. "Simple" name changes

Under former section 9-402(7) if a name change was seriously misleading then to be perfected as to collateral acquired more than four months after the name change, a secured party was required to file a financing statement under the corrected name. Note that the original filing was effective as to collateral owned by the debtor or acquired by the debtor within four months after the name change and also was effective as to collateral acquired by the debtor more than four months after the change if the name change was not seriously misleading.

New Article 9 continues to treat "simple" name changes as they were treated under former section 9-402(7) but the rules are broken out into several sections. New section 9-507(b) provides a general rule according to which in other than new debtor cases, and except as provided otherwise in other sections, a financing statement containing information that has become misleading continues to be effective.

Under new section 9-507(c)(1), if the debtor’s name changes so that the name becomes seriously misleading the financing statement continues to be effective as to collateral in existence at the time of the change and also collateral acquired up to four months after the change. However, under new section 9-507(c)(2), to be perfected as to collateral acquired more than four months after the change the secured party must file an amendment that renders the filing not seriously misleading within the four-month period following the name change.

As explained in Chapter 14 (The Nitty Gritty of Filing), under new section 9-506 name changes are seriously misleading unless a financing statement would be found in a proper search under the search process employed by a particular filing office.

If a secured party timely files an amendment (i.e., files an amendment before the end of the four-month period) then the security interest is continuously perfected -- meaning perfection dates back to the original filing. What happens if a secured party attempts to amend a financing statement after the four-month period has expired is not entirely clear.

One might reasonably expect that the corrected financing statement would operate to perfect a security interest in collateral acquired more than four months after the change but that the perfection is not continuous and rather dates from the filing of the amendment. However, new section 9-507(c)(2) states: